5 Policies to Create a Fair Health Care Market

March 30th, 2022

This week, actuaries with the Centers for Medicare and Medicaid projected health care spending will grow to reach almost $6.8 trillion by the year 2030 and consume nearly 20% of the country’s gross domestic product, or one in every five dollars spent. A significant portion of that spending is paid by private and public employers, which in turn, acts as a drag on both business growth and household incomes.

As innovative employers seek market solutions to wrangle health care costs while improving the quality of care they offer working Americans, they also recognize that the government has a role to play in ensuring they have a functional marketplace in which to purchase health care on behalf of their companies and employees. They have been eager to see action on the part of the Centers for Medicare and Medicaid Services (CMS) Innovation Center and Health and Human Services to help tamp down the ever-climbing health care costs that come out of their budgets – action they have yet to see.

Here are five policy areas employers want to see implemented.

1. Addressing Market Consolidation and Anti-Competitive Practices

Health care system consolidation is not a new problem, but it has gained attention over the past several years, particularly in light of a slew of megamergers proposed during the COVID-19 pandemic. In an executive order signed in July 2021, President Biden directs the Department of Health and Human Services to move forward with price transparency requirements, and directs the Department of Justice and Federal Trade Commission (FTC) to review and revise guidelines for challenging future consolidation by health systems. New guidelines would make it more likely that the FTC will intervene to stop anti-competitive mergers among health systems, improving the competitive landscape and combating rising health care costs that land on employers and other large purchasers, as well as consumers.

In addition, Congress should prohibit anti-competitive practices that have enabled some health systems to gain market power and raise prices. These practices have included anti-tiering and other contract terms that were the target of a successful lawsuit against Sutter Health System in California. The Healthy Competition for Better Care Act (S 3139), a bipartisan bill introduced by Senators Braun and Baldwin, would take on these practices. Federal legislation is also needed to prohibit drug manufacturers’ practices such as “patent evergreening” and other “patent thickets” to ensure that branded products will face healthy price competition from generic drugs and biosimilars in line with the intent of current laws.

2. Universal “Site Neutral” Payment

Medicare, along with other payers, often pay substantially more for the same care if it is delivered in a hospital outpatient department, rather than in a physician’s office, even when the service is identical. The higher payment rates put independent physician practices at a disadvantage and encourage more industry consolidation. What’s more, the higher prices charged by practices owned by a hospital system tend to be hidden from patients, causing unexpected – and often excessively elevated — out-of-pocket costs.

Universal site-neutral payments – the same pay for the same service — would save the health care system more than $350 billion (and as much as twice that) if adopted by all payers. It would also balance the playing field for independent physician practices.

3. Support for Physician-Led Accountable Care Organizations and Alternative Payment Models

All the evidence suggests that physician-led Accountable Care Organizations and alternative payment models, including those that pay clinicians prospectively to manage patient care, are more successful than hospital or payer-led models. Large employers and purchasers are interested in seeing CMS take an active hand in promoting these efforts. Policymakers can support the success of physician-led ACOs by helping them create the infrastructure needed to take on financial risk, invest in high-value care and develop partnerships with other organizations to provide comprehensive care. This includes providing financial incentives for quality performance to encourage providers to redesign care to improve health outcomes. CMS and leading payers need to communicate clear outcomes objectives and attach significant rewards and penalties providers’ performance.

In addition, a recent PBGH survey of large employers found that nearly six in 10 see low investment in primary care as a barrier to better employee health. Roughly 90% said they would be in favor of reallocating funds to primary and preventative care. One way to finance this effort, which employers would like to see CMS support, is to redirect money paid to health plans for care coordination to physician practices engaged in advanced primary care.

4. Renewed Push for Build Back Better – Including Prescription Drug Price Relief

President Biden’s nearly $2 trillion Build Back Better (BBB) proposal included provisions on drug pricing, but the effort was stymied. On Jan. 19, 2022, President Biden suggested in a press conference that the Senate would break the BBB bill into pieces, attempting to pass provisions that have support of all 50 Democratic Senators.

The current legislation would allow Medicare to negotiate on the price of certain high-cost sole-source drugs after their patent and market exclusivity periods have expired. It would also impose strict inflation caps on all high-cost sole-source drugs. Importantly, those inflation caps would apply to all purchasers, not just Medicare. If enacted, this provision would save employers, other health care purchasers and consumers tens of billions of dollars over the next decade.

5. Holding Drug Makers and Third-Party Organizations Accountable for Drug Prices

Policymakers have been looking at opportunities to increase transparency and accountability of pharmacy benefit managers (PBMs) and others in the drug supply chain. The Trump Administration’s Transparency in Coverage rule, which is being implemented by the Biden administration, albeit on a somewhat delayed timeframe, includes significant new drug price transparency requirements of health plans and PBMs. Not surprisingly, the Pharmacy Care Management Association (which represents PBMs) has sued the administration to stop implementation of certain sections of the rule. If implemented, the rule would require PBMs to report on negotiated rates and historical net prices for covered prescription drugs. Combined with the Consolidated Appropriations Act (CAA), which ultimately requires PBMs to provide the information employers need on prescription drug spending to meet their obligations under the law, would be impactful.

Importantly, no explicit statutory authority exists for policymakers to regulate PBMs directly. What is needed is for policymakers to establish direct oversight authority for PBMs in all markets. AND we need PBMs to be held to the same fiduciary standards that self-funded employers are held to. Only then will we get the accountability we need.

Vertical Integration Isn’t Great for Health Care Consumers or Purchasers

August 23rd, 2021

In 2017, pharmacy giant CVS announced its purchase of insurer Aetna for $69 billion in the largest-ever health care merger. This is just one example we have seen in recent years of the acceleration of acquisitions combining traditionally independent elements of the health care supply chain.

Problems posed by vertical integration

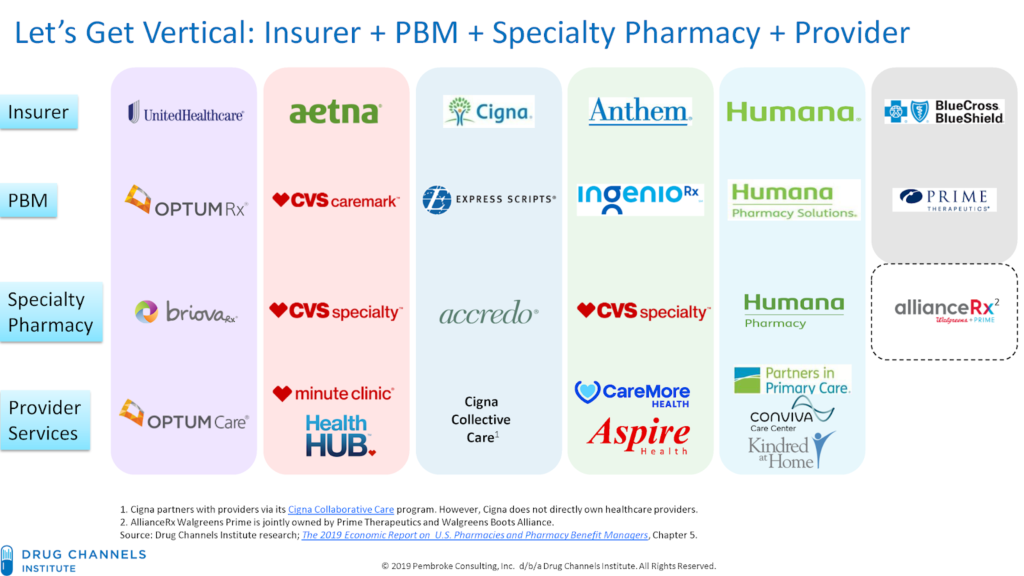

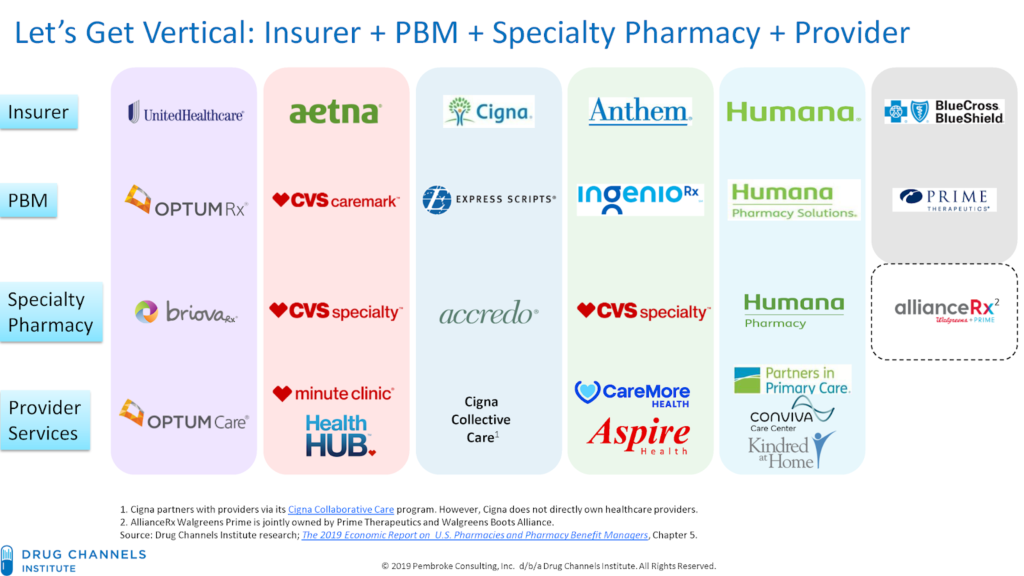

Known as vertical integration mergers, these deals have led to hyper-consolidation between health insurers, providers, pharmacy benefit managers (PBMs) and other sectors of the health care market. Today, three entities—CVS-Aetna, Cigna-Express Scripts and UnitedHealth-OptumRx—control nearly 80% of the PBM market. OptumCare, owned by UnitedHealth, now employs or is affiliated with 50,000 physicians and 1,400 clinics, and they anticipate hiring at least 10,000 more providers by the end of 2021.

While the emerging mega-companies have argued that mergers help consumers and purchasers by holding down costs, there is scant evidence that increased consolidation reduces inefficiency and waste, improves quality or decreases costs. On the contrary, evidence suggests market consolidation, including vertical integration, has contributed to rising costs and lower-quality care.

One recent study found that diagnostic imaging and laboratory referrals from physicians increased significantly after the physicians’ practices were acquired, boosting Medicare spending by $73 million during a four-year-period across the 10 imaging and lab services reviewed. Another study that examined claims data from 2009 to 2016 determined that the odds of a patient receiving an inappropriate MRI referral increased by more than 20% after a physician transitioned to hospital employment.

More aggressive oversight needed

The only solution to the problems posed by the increasing number of vertical integrations in the health care industry is more aggressive oversight and enforcement of anti-trust laws.

The federal government has begun to take steps toward the oversight needed. Guidelines issued by the Federal Trade Commission (FTC) and Department of Justice in June 2020 represent the first-ever vertical merger-specific guidelines and replace broader merger guidance published in 1984. Although vertical mergers traditionally have faced little scrutiny by regulators, the new rules may usher in a more aggressive chapter of anti-trust enforcement around the transactions.

In July 2021, the Biden administration signaled it was taking seriously risks associated with vertical mergers in a sweeping executive order aimed at increasing competition and reducing anti-competitive consolidation across multiple sectors. The order contains directives for the Justice Department and FTC to “enforce the anti-trust laws vigorously” with respect to hospital mergers. It also directs federal agencies to address consolidation in other health care sectors, including pharmaceuticals and health insurance.

In another positive sign, the Department of Justice sued to stop the merger of Aon and Willis Towers Watson, two of the nation’s largest insurance brokers. Though an example of horizontal, rather than vertical integration, the suit – which led to the two companies calling off the merger in July – demonstrates the administration’s skepticism of greater consolidation in the health care industry. As alleged in the suit,

Aon and Wills Towers Watson operate “in an oligopoly” and “will have even more [leverage] when [the] Willis deal is closed.” If permitted to merge, Aon and Willis Towers Watson could use their increased leverage to raise prices and reduce the quality of products relied on by thousands of American businesses — and their customers, employees, and retirees.

Health care mergers, whether vertical or horizontal, must benefit the people served by the entities involved. The federal government’s continued steps to strengthen anti-trust laws and closely review every proposed merger is essential to getting costs under control and ensuring Americans have access to quality health care services.

Addressing Market Failure: Lowering Health Care Costs for Americans

August 4th, 2021

The United States is facing a crisis when it comes to health care costs. Prices for lifesaving, necessary care and drugs are simply too high for consumers.

Recent surveys have found that roughly one quarter of people in the country find it difficult to afford their prescription drugs, and three-in-ten say they haven’t taken prescribed drugs due to high costs. For some, the cost of prescription drugs is literally a matter of life-and-death. By 2030, 112,000 seniors each year could die prematurely because drug prices and associated cost-sharing are so high that they cannot afford their medication.

In 2019, 158 million Americans received health coverage through their employer. That’s nearly half the total population as estimated by the U.S. Census Bureau. This means high costs also place significant financial burden on employers that provide health benefits to employees and their families. This comes at the expense of core business investments and holds down wages, dampening business growth.

Why are health care costs so high?

Health care industry consolidation is increasing the market power of dominant hospitals, health systems, physician groups and drug companies. This has enabled them to raise prices beyond what is reasonable or necessary in the commercial market.

Some hospitals, health systems and physician groups use their market power to bully health plans, employers and ultimately patients, into contract terms that drive up costs with no corresponding increase in value. An example of this is the ongoing lawsuit against Sutter Health in California. Sutter used its market leverage to force large companies and their insurers into contracts with terms that drove prices up but did not add value for the employers or their employees. A settlement, including a payout to the employers and injunctive relief, has been announced but is still pending final approval after a 10-year court battle. This will be a victory for these employers, and the suit – particularly its injunctive relief, which requires the health system to end its anti-competitive business practices – provides a roadmap for nationwide reform that could dramatically improve costs. We need wide-scale solutions to address the problem broadly, and cannot wait for decade-long court cases to solve this problem one health system at a time.

Yet, the problem seems to be accelerating. Between January 2019 to January 2021, hospital and other corporate entities acquired 20,900 physician practices, resulting in a 25% increase in corporate-owned practices. With the decrease in independent practices comes a decrease in the competition necessary to ensure healthy markets, allowing large corporate entities to use their market power to drive prices up for non-hospital care.

Further, through manipulation of patent and market exclusivity laws, including “patent evergreening” and “patent thickets,” pharmaceutical companies have thwarted market competition by keeping drugs under patent well past their original expiration. While prices of brand name drugs continue to rise, the pipeline of innovative treatments has begun to dry up. Today, 78% of drug patents are not for new drugs, but for minor changes to existing ones. Patents should encourage and reward innovation, not be used to discourage market competition.

What can we do about it?

There are two main ways to address the issues at the root of the ever-rising health care costs – strengthen anti-trust enforcement and prohibit specific anti-competitive practices.

Strengthening anti-trust enforcement

All federal agencies with the authority to enforce laws meant to promote free and open markets must do so to protect American consumers. The federal government has begun to take action to strengthen anti-trust enforcement. In President Biden’s recent executive order on promoting competition in the American economy, he directs the Department of Justice and the Federal Trade Commission (FTC) to enforce anti-trust laws vigorously.

The executive order also encourages the Department of Justice and the FTC to review the horizontal and vertical merger guidelines and consider revision. The guidelines should be revised to address the increased industry consolidation behind the rising costs of health care. Additional staff and resources are also needed to support the work of the federal agencies working to enforce anti-trust laws.

On the state level, regulatory bodies should closely monitor mergers and acquisitions to ensure they meet public benefit requirements, meaning they are beneficial to the communities in which the entities operate.

Prohibiting specific anti-competitive practices

Legislation that specifically regulates anti-competitive contracting practices should be prioritized by Congress and moved expediently. The Lower Health Care Costs Act, which was passed on a bipartisan vote by the Senate HELP Committee in 2019, specifically addresses anti-competitive terms in facility and insurance contracts that limit access to higher quality, lower cost care. This would address the issues with contracting practices used by health systems like Sutter Health to hold employers and health plans hostage. The bill is still awaiting a vote by the full Senate.

We must end the gaming of the patent system that allows drug manufacturers to reduce competition for expensive brand-name drugs. President Biden’s executive order on promoting competition also directs the Department of Health and Human services to take action on the cost of prescription drugs. Specifically, he directs the department to lower prices and improve access by promoting generic drug and biosimilar competition, ensuring patents incentivize innovation and are not used simply to delay the development of generic drugs and biosimilars, supporting the market entry of lower-cost generic drugs and biosimilars and preparing for payment models to support increased utilization of generic drugs and biosimilars.

Support for Government Intervention to Solve Rising Health Care Costs

July 21st, 2021

Ever-rising health care costs are causing many across the political spectrum to rethink their priorities and positions on key health care policy issues. In fact, two recent surveys show both a majority of voters and a majority of executive decision makers at large private employers support government intervention to lower health care costs.

Public support

According to a survey conducted by a bipartisan polling team and supported by Arnold Ventures, 90% of voters say it is important for Congress to take action to reduce health care prices. Additionally, more than two-thirds of voters indicated that reducing health care costs is their top priority for the President and Congress, above other high priorities like investing in infrastructure and providing support for small businesses.

When asked about limiting the prices that hospitals can charge to no more than two times what Medicare pays, 78% of voters expressed support. Limiting hospital prices has broad support among all voters, regardless of political party, with 82% of Democrats and 74% of Republicans supporting it. This is a clear demonstration that lowering out-of-control health care costs is not a partisan issue.

The results from this survey of voters closely mirror the results from a survey of executive decision makers at more than 300 large private employers conducted by PBGH and the Kaiser Family Foundation (KFF). The survey found significant concerns regarding health care costs, and a significant majority of responding large employers, 83%, agreed that the cost of health benefits is excessive. In addition to agreeing that costs were excessive, 87% of respondents believe that the cost of providing health benefits to employees will become unsustainable in the next five to 10 years, and 85% believe that there will need to be greater government roles in providing coverage and containing costs.

Employers did not blame one cause for excessive costs, with large shares agreeing that the cost of prescription drugs, provider market consolidation and increased market power, volume-based payments and unhealthy behaviors are factors for high costs.

The underlying problem

How we view health care in the United States is changing. The COVID-19 pandemic has made even more clear the problems with our current system, including high costs, incomplete coverage, limited access to care, under-investment in public health and serious racial and ethnic inequities. These problems existed before the pandemic, but it has brought these issues and other problems with our health care system to the forefront.

The bottom line is the cost of health care in the U.S. has become unaffordable for families and employers and health outcomes are poor. High health benefits costs come at the expense of core business investments and hold down wages, dampen business growth and squeeze family budgets.

Increasingly high health care costs for private purchasers in the U.S. are driven primarily by high prices in the commercial sector. Hospital prices in commercial plans across the U.S. in 2018 averaged 247% of Medicare payments and the gap has been increasing. This trend is largely the result of industry consolidation and use of anti-competitive contracting practices and pricing strategies by hospitals, health systems and provider groups to gain market power.

The lack of functional and effective markets in the private health care system is driving the out-of-control health care costs too many of us are faced with. Effective markets require healthy competition among providers, health plans, drug manufacturers and suppliers; transparent information on quality, patient experience, health equity and prices and meaningful choices for consumers. Unfortunately, these conditions are not met in all markets; costs are higher in those markets as a result.

The solution

In some market segments and geographic areas, the potential for healthy competition exists. But markets are threatened and undermined by dominant industry players. In these situations, government needs to strengthen anti-trust enforcement and explicitly prohibit anti-competitive practices that have been the driver of high prices. In other areas, the market is fundamentally broken and it is nearly impossible to address costs through competition. In these situations, government needs to step in to limit prices.

The problem is clear and requires direct government action. We know the majority of voters and executives at large employers overwhelmingly support the kind of action needed. Our leaders simply have to be willing to address the root causes of the problem.

The Biden administration has acknowledged the health care cost problem. Recently, President Biden issued an executive order to promote competition in the American economy. The order directs federal agencies to take steps to restore healthy competition to health care markets. It targets two key factors behind overall high health care costs – drug costs and hospital costs. Our policy makers must continue to work lower health care costs with concrete policy solutions.

Private Equity Poses Grave Threat to Health Care System

June 23rd, 2021

Operating largely beneath the public and regulatory radar, private equity firms have gravitated toward health care over the past decade in pursuit of outsized profits. Investments jumped 189% between 2010 and 2019, from $41 billion to $120 billion, and have totaled $750 billion over the last decade.

Health care acquisitions now represent 18% of all private equity investments, up from 12% in 2010. Key acquisition areas include outpatient care, home health, emergency medicine, dermatology, hospice and elder and disabled care.

Of course, it should come as no surprise that private equity has gravitated to health care. The health care sector is rife with economic distortions and outright market failures that allow unscrupulous actors to earn outsized returns if they are willing to act aggressively and ignore the public good.

Private equity’s expanding presence in health care has increased purchaser costs, fueled a dramatic rise in surprise billing, undermined competition and threatened markets already diminished by the pandemic.

Surprise Medical Bills: A Major Market Failure

Many surprise bills are triggered by private equity business models that intentionally withhold provider groups from insurer networks to extract maximum out-of-network payments from patients. As such, they represent a major market failure in our health care system, one that has imposed punishing bills on unsuspecting patients and added more than $40 billion in additional costs for those with employer-sponsored insurance.

Congress passed the No Surprises Act last year to put an end to surprise medical billing. But just how effective the law will be remains to be seen. Much will depend on how regulators interpret and implement the act’s legislative intent. The rulemaking process is required to wrap up in December 2021 and the law is scheduled to take effect in January 2022.

With the details of the implementation guidelines still very much in flux, legislators need to step in to ensure that the final rules truly protect consumers and produce lower overall costs for purchasers.

Highly Leveraged “Roll-Up” Acquisitions

Along with the damage done by surprise billing, private equity’s go-to business model also undermines the system by focusing on rapidly increasing revenues through highly leveraged “roll-up” acquisitions across markets or regions. Researchers say the approach destabilizes already fragile markets by increasing consolidation, undermining competition and amplifying anticompetitive practices.

Aggressive acquisition strategies, researchers argue, also infuse significant risk into health care markets by loading providers with debt, stripping them of assets and putting them at risk for long-term failure.

While the 2020 closure of Hahnemann University Hospital, a 500-bed teaching facility in Philadelphia, was driven by multiple financial problems over decades, private equity ownership during the hospital’s final years led to a closure process that was “chaotic, uncoordinated and fundamentally not aligned with the needs of the patients and trainees that make up the core constituents of a teaching hospital.”

Approximately 175 nurses, managers and support staff were laid off a little over a year after the hospital was acquired by American Academic Health System LLC. Despite a cease and desist order prohibiting any action toward closure, the owners began cutting vital hospital services, including trauma and cardiothoracic surgery. With the closure that soon followed, the community lost a vital safety net facility that had handled more than 50,000 emergency department visits per year in an underserved area.

The 171-year-old hospital’s unraveling at the hands of a private equity firm prompted an unusually blunt statement of condemnation from Pennsylvania Governor Tom Wolf and Philadelphia Mayor Jim Kenney: “The situation at Hahnemann University Hospital, caused by CEO Joel Freedman and his team of venture capitalists, is an absolute disgrace and show a greed-driven lack of care for the community.”

New Controls Needed

As the situation in Philadelphia showed, private equity investments are often beyond the reach of government oversight. The vast majority of health care deals are unreported, unreviewed and unregulated under existing law. And even when transactions are reportable, researchers say, the complex structure of private equity funds conceal the competitive impact of those deals.

Beyond working to ensure that implementation of last year’s No Surprises Act fulfills congressional intent of halting surprising billing and lowering overall health care costs, an array of other approaches for mitigating the destructive impact of private equity is needed. These include more aggressive anti-trust enforcement by the Federal Trade Commission and greater scrutiny of health care mergers by the Department of Health and Human Services. Further, Congress can take action by enacting policies to ban anti-competitive contracting practices that have driven up health care costs in cities all over the country.