5 Political Sticking Points that Could Derail COVID Legislation

August 4th, 2020

The Senate is working to pass another major COVID-19 bill, and the details of that legislation are of great concern for large private employers and health care purchasers seeking to manage COVID-19 costs during the sharpest economic contraction since the Great Depression.

Five priorities of large employers were outlined in a previous post. While all of those priorities come with their own detractors and will not be easily won, they are not the most headline-grabbing flashpoints likely to derail the Phase 4 Legislation.

Here are the five biggest disagreements likely to cause heartburn for negotiators.

- Size and Scope: Before House, Senate, and Administration negotiators can begin to tackle individual policy priorities, they will need to come to some agreement on the overall size and scope of the legislation. The House Democrats’ HEROES Act comes in at $3 trillion – the most expensive bill ever to pass a chamber of Congress – and includes policies affecting the economy well beyond the COVID-19 pandemic. Senate Republicans have insisted on keeping the bill to under $1 trillion and ensuring all its provisions are directly related to the pandemic. The White House has not provided an overall budget target, but seems to favor more spending if necessary to improve the economy in advance of the November elections.

- Unemployment Insurance Extension: The CARES Act provided $600 per week in enhanced unemployment benefits to those laid off during the pandemic, but the benefits expired at the end of July. The HEROES Act extends the expanded unemployment benefits at $600 per week through the end of January 2021. The White House and congressional Republicans have grudgingly agreed to extend the program, but at a lower amount.

- Business Liability Protection: Senate Majority Leader Mitch McConnell (R-KY) has insisted that the legislation must include comprehensive liability protections for businesses, schools, and other entities against legal claims based on the spread of COVID-19. Democrats did not include such protections in the HEROES Act.

- State and Local Fiscal Relief: Conversely, House Democrats have pushed hard for substantial spending to help offset tax revenue decreases and COVID-related expense increases for states and localities, including more than $700 billion in such relief in the HEROES Act. Senate Republicans and the White House have shown little interest in such spending.

- Stimulus Checks: The CARES Act provided up to $1,200 per adult and $500 per child in direct stimulus checks to Americans. House Democrats propose another round of checks at the same amount, but congressional Republicans are less enthusiastic. The White House has signaled its support for another round of stimulus checks, noting their likely popularity in an election year.

The August recess is officially scheduled to begin on Aug. 8 – the end of this week. But with so many disagreements between the major players, this negotiation could well last until the middle of the month or even later.

6 Things Large Employers are Watching for in the Next Round of COVID Legislation

July 27th, 2020

More than three months after enactment of the landmark CARES Act, and more than two months after the House of Representatives passed the HEROES Act – their own “Phase 4” legislation – the Senate is finally taking steps to pass another major bill responding to the still raging COVID-19 pandemic. As the likely last chance to pass major legislation before the November elections, this bill is particularly vital for employers and health care purchasers seeking to stay financially stable and manage COVID-19 costs during the sharpest economic contraction since the Great Depression.

Congressional and White House negotiations over this high-stakes (and likely more than $1 trillion) bill will dominate the headlines coming out of the nation’s capital for the next several weeks. PBGH and its employer/purchaser allies have weighed in with Congress and the Administration, including in two letters this week, focused on testing and our other priorities, signed by more than 30 national, regional, and local purchaser organizations. Here are the six employer priorities you should watch out for in the weeks ahead and the six sticking points that could spell trouble for the bill.

What Employers and Purchasers Want to See

- Stopping Price Gouging and Ensuring Fair Prices: Since the pandemic began to affect the United States in February, stories have abounded about bad actors engaging in egregious pricing of critical equipment. While largely limited to personal protective equipment (PPE) and testing, price gouging could get worse as the pandemic wears on. Of particular concern, the CARES Act, enacted in March, stipulates that all health insurance plans must cover the cost testing in full for employees without placing any limit on what a provider may charge for a test. The House-passed HEROES Act could further exacerbate the problem by mandating coverage – with no out-of-network price limitations — for all COVID-19 treatment.Large employers are urging Congress to not mandate that they cover these costs in full without appropriate guardrails to ensure fair prices for out-of-network care and testing. Further, a blanket ban on price gouging for COVID-19 supplies and services, enforceable by the Federal Trade Commission and state attorneys general, is essential to ensuring a fair and reasonable market.

- Banning Surprise Billing: Surprise billing has been a top priority for employers and purchasers for several years, and while Congress has come close to banning this egregious practice, it has not yet reached a final agreement. Recognizing that this may be their last opportunity, congressional leaders, led by retiring Sen. Lamar Alexander (R-TN), are pushing to include a ban in the upcoming bill. Sen. Alexander’s legislation would ban surprise billing while stipulating a market-based benchmark price for out-of-network care. Such a benchmark has been found to reduce health care costs over time for consumers, purchasers, and taxpayers alike.

- Providing Subsidies for COBRA Coverage: The pandemic has led to the sharpest rise in unemployment in the nation’s history. With millions of people laid off or furloughed, the number of uninsured people has spiked. Employers want to ensure the availability of direct subsidies for COBRA coverage so that laid off and furloughed workers can continue to stay on their employer-sponsored insurance without having to pay the full – and often unaffordable – premium.

- Federal Funding for Testing: Nearly six months since COVID began to spread in the United States, the country still lacks sufficient diagnostic tests to provide timely access to COVID-19 diagnosis. With obvious concern about getting the U.S. economy back on its feet, and a recognition that the health of American citizens and the economy are interwoven, large employers are looking to Congress to infuse new federal spending to ensure timely access to tests for all who need them.

- Financial Support to Struggling Primary Care Providers: Paradoxically, the pandemic has led to a significant decrease in utilization of health care, particularly for primary care providers. Many such providers are struggling to keep their doors open during the ongoing pandemic. According to survey findings from a provider survey conducted by the Larry Green Center at Virginia Commonwealth University, 40% of primary care clinicians say they may lack the financial resources to stay open through the end of August. Employers are looking to Congress to set aside a portion of funds already appropriated to the Provider Relief Fund for struggling primary care providers.

- Policies to Mitigate Risk in the Employer Health Insurance Market: While health care spending is down since the beginning of the pandemic, many patients are deferring necessary care. Faced with a possible spike in utilization next year, purchasers are unable to accurately project spending into 2021. That’s why they’re largely supporting the establishment of a one-sided risk corridor that would provide financial support to purchasers if costs substantially exceed projections.

The August recess is officially scheduled to begin on Aug. 8, but negotiators are already signaling that they may not reach final agreement by then. Hopefully, employers will have a clear indication of what is in and what is out by the middle of the month.

5 Pandemic Takeaways: Large Employers See COVID-19 as Catalyst for Systemic Health Care Change

July 8th, 2020

COVID-19’s long-term impact on U.S. health care remains unclear, but amid the ongoing turmoil and uncertainty, large employers see opportunities for much-needed reforms.

Elizabeth Mitchell, president and CEO of Pacific Business Group on Health (PBGH) and Lisa Woods, PBGH chair and senior director, U.S. Healthcare for Walmart, recently outlined five key takeaways from the pandemic during an online summit on the future of health care in a post-COVID world.

PBGH works with some of the nation’s largest employers in addressing health care purchasing challenges. Member organizations include 40 public and private entities that collectively spend $100 billion annually purchasing health care services on behalf of more than 15 million Americans.

Among the repercussions of COVID-19 from an employer perspective, according to PBGH’s Mitchell and Woods:

1. Telehealth is the future. Telehealth will continue to gain traction as a means of delivering appropriate care from a distance. Close to half of physicians are using telehealth in the wake of the pandemic, up from less than 20% two years ago. Analysts expect virtual physician visits will rise by 64% in 2020.

“We’re looking at ways to ensure that our associates can get the care they need in their home communities if they don’t feel comfortable traveling,” Woods said.

“We have been very focused on telehealth [at Walmart] and feel like it is the future,” Woods said.

2. Primary care needs more investment. With many primary care physician groups struggling due to fewer office visits triggered by concerns about COVID-19 exposure, fears are rising that provider consolidation will continue to accelerate, leading to ever-higher health care costs.

PBGH recently joined 35 other employer-focused organizations in urging Congress to impose a 12-month ban on mergers and acquisitions for health care organizations that received federal bailout relief. PBGH also is calling for immediate federal assistance for vulnerable primary care practices and the elimination of all or part of cost-sharing requirements for primary care visits.

Employers additionally want to see a greater emphasis placed on mental health and public health within the context of primary care and are looking for ways to positively impact social determinants of health (education, finances, food and housing insecurity, transportation).

“We haven’t been paying for the right things,” Mitchell said. “We’ve been focused on expensive tertiary care and elective procedures, and we need to focus on primary care. That’s how we keep people healthy and out of hospitals.”

3. Employers are hyper-focused on quality. “We know there are huge opportunities to identify how to get better outcomes, and we think purchasers are going to lead that charge,” Mitchell said.

Woods pointed to PBGH’s Employers Centers for Excellence as an example of the kinds of solutions employers will increasingly turn to in the pandemic’s wake. Through a rigorous evaluation and qualification process, PBGH has identified regional care centers that deliver high-quality elective surgical care for PBGH member-employees.

The centers were pioneered by Walmart and have been instrumental in helping PBGH members improve quality and reduce costs.

4. Employers want more control over contracting. Employers continue to be deeply concerned about health care costs that have been rising irrationally for years and worry the pandemic will fuel even higher prices.

Mitchell said financial pressure from COVID-19 has only exacerbated those concerns and will likely accelerate employer efforts to gain greater control of the health care purchasing process through direct contracting and other quality improvement and cost reduction efforts.

Direct contracting between employers and providers represents a promising solution, she said, because it creates an opportunity to “cut out the noise in the middle” to produce better and more cost-effective outcomes through collaboration between employers and providers.

5. The pandemic is forcing innovation. “[Employers] are going to be forced to innovate much more rapidly than they might have anticipated, because you can’t sustain a bloated, inefficient [health care] system in this environment,” Mitchell said. “The health care system didn’t fix itself, so employers are going to step in and fill that gap.”

In addition to boosting quality, Woods said eliminating unnecessary care—estimated to account for about one-third of all care provided—represents a key objective for employers. She noted that as providers ramp up from the pandemic-driven shutdown of recent months, it will be important to find ways to prevent unnecessary care from creeping back into the system.

The June 22-25 virtual summit during which Mitchell and Woods spoke was produced by Global Health Care, LLC, and included a wide range of presenters, from health plan and hospital executives to clinicians, educators and former policymakers. Their discussion can be viewed online here.

Experts Highlight Role of Digital Tools in Reducing COVID-19 Transmission

June 30th, 2020

Like a wind-driven wildfire, the COVID-19 pandemic continues to flare and race across the U.S. and around the world, jumping firebreaks to threaten health and livelihoods and imperil long-term economic sustainability.

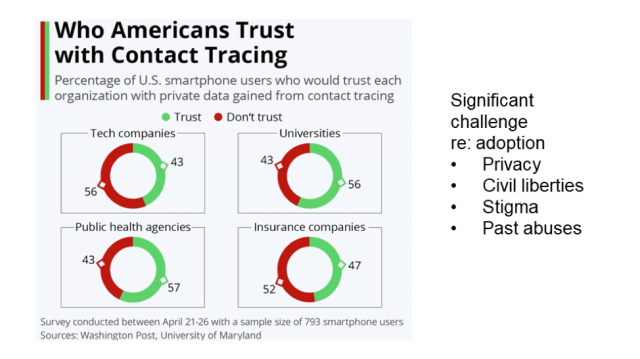

Short of a vaccine, digital contact tracing apps—coupled with a sustained commitment to social distancing and masks—offer the hope for arresting the virus’ spread, two health technology experts recently told Pacific Business Group on Health (PBGH) members.

Related digital tools known as health verification apps can help support and modulate community re-openings by aligning self-reported health assessments with organization-and site-specific guidelines, according to Brian McClendon and Marci Nielsen, Ph.D. co-founders of the CVKey Project. The two presented during a PBGH webinar June 26.

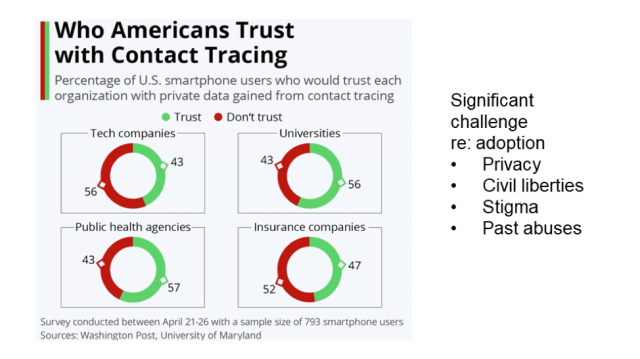

The success of digital apps in reducing the transmission and impact of COVID-19 will hinge on widespread, voluntary buy-in by the U.S. population, McClendon and Nielsen said. Given substantial mistrust of both government and large technology firms, developing solutions that safeguard privacy and civil liberties is paramount.

Lawrence, KS-based, non-profit CVKey Project was launched in May to pursue the goal of helping communities open responsibly without compromising personal privacy. McClendon is the founder of Google Earth and a former Google vice president; Nielsen is the former chief executive officer of the Washington, D.C.-based Patient-Centered Primary Care Collaborative.

Limitations of manual contact tracing

Traditional or manual contact tracing is designed to break the chain of exponential disease transmission by quickly working backward from known infected patients to identify and alert those with whom the individual has recently interacted. Public health workers then advise the exposed party to isolate or quarantine, depending on their condition and symptoms.

Significant barriers can undermine the efficacy of manual contact tracing, not the least of which are the labor-intensive nature of the process and the reluctance of many to accept calls from unknown numbers, Nielsen said. And if contact is established, a high level of trust must be established between the health worker and exposed individual to ensure appropriate action is taken.

Moreover, McClendon said, accelerating rates of infection in many states are making traditional contact tracing problematic. Florida, for example, has successfully traced the origins of 50% of their infected population. But with close to 9,000 new cases reported recently in one day alone, rapidly isolating the origins of each infection has become increasingly impractical.

Augmenting with digital tools

Digital solutions can serve as force multipliers that enable contact tracers to work faster and more effectively. Voluntarily downloaded apps identify whether, when and where a person has been in close proximity of an infected individual. A range of these solutions are emerging, McClendon said, though some are less effective than others. GPS-based technologies, for example, are both privacy invasive and not sufficiently accurate when it comes to identifying an individual’s location, particularly indoors, he said.

An alternative approach jointly developed by Google and Apple, known as Google/Apple Exposure Notification, mitigates the privacy and accuracy limitations of GPS-based apps by relying on Android and iPhone Bluetooth capabilities. The technology generates random number sets and then pairs with other phones that have the app installed.

The number sets are stored on the phone to assure privacy and if an individual tests positive for COVID-19, they’ll be asked to voluntarily upload their number sets to cloud storage run by a state or county agency. The process creates a mechanism for other apps to identify an exposure and notify the phone’s owner but also enables the original infected individual to remain anonymous.

The exposure notification will ask the user to alert a manual contact tracing team and a determination can be made whether isolation or quarantine is appropriate. Importantly, McClendon added, no data is shared with Google or Apple, and the random number strings prevent identification of infected and non-infected individuals by health authorities. Moreover, individuals’ whereabouts are never identifiable. Physical proximity to an infected individual is communicated to the user to inform their next steps.

Health verification apps

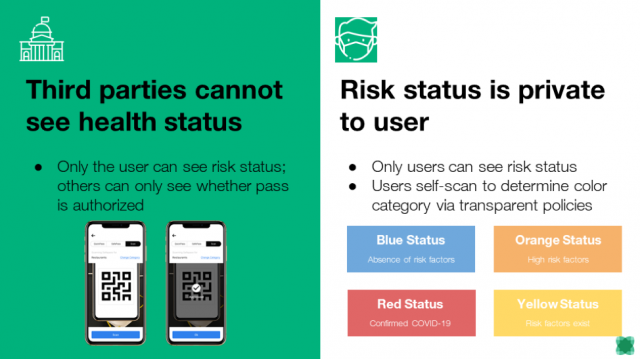

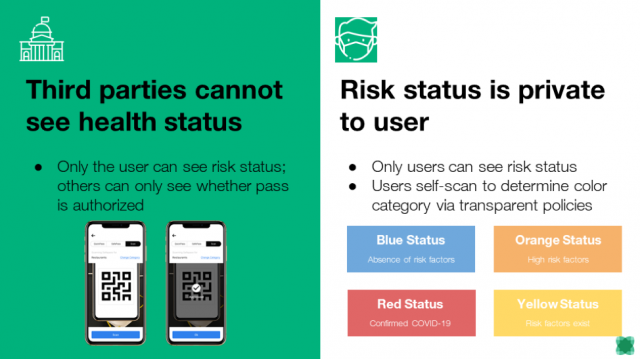

The CVKey project founded by McClendon and Nielsen is focused on the development of a related app that can help communities, companies and other organizations adjust economic, employment, educational and social activities based on up-to-date regional public health and community guidance. The CVKey opt-in app allows users to check their own health and potential exposure status through a series of questions to self-identify risk factors for spreading the virus.

Depending on their answers, the user is assigned one of four color-coded conditions or states. These include Blue, for no known risk factors; Yellow, for when an exposure has occurred; Orange, for both exposure and symptoms; and Red, for users that have tested positive for the virus.

McClendon said the data is stored on the individual’s phone and never uploaded to any central database. The app does, however, download policies set by specific businesses and organizations to delineate rules of entry, which are then compared with the person’s health status. Based on these comparisons, a QR code is produced and the user informed if they may enter a specific building or not and what requirements might be in place, e.g. mandatory masks or off-limit areas.

A key objective of the tool, McClendon said, is to provide both individuals and organizations with data-driven, real-time safeguards to help eliminate potential exposures. Scanning an individual’s code at a restaurant and limiting access to those with a Blue condition, for example, would help ensure both safety and peace of mind for diners and staff.

The app’s additional ability to inform users of updated company or building-specific policies based on changing conditions could provide a “dimmer switch” that would help health authorities and employers reduce transmission risk without the need for a blanket lockdown.

The CVKey app is being piloted this fall at the University of Kansas, McClendon said. The QR coded displayed by the app will provide the university’s building monitors with a simple yes or no indication as to whether the individual’s health assessment meets the criteria to enter the building that day. Anyone generating a Yellow or Orange condition will be asked to communicate with the university’s health department.

“Our message to communities is that if you can help employers choose to adopt this app, there will be less chance of going into another lockdown,” McClendon said.

Primary Care Practices Can Engage Patients in Virtual Care

June 6th, 2020

During the most challenging phases of the COVID-19 pandemic, one opportunity for the health care delivery system has been the rapid adoption of telehealth and virtual care by both primary care practices and patients. The Pacific Business Group on Health’s California Quality Collaborative (CQC) has hosted webinars to support and spread successful practices in virtual care for independent primary care practices and IPAs as they rapidly implemented telehealth technology and workflows.

Nationally, the trends reflect widespread virtual care adoption. By one May 2020 analysis, telehealth visits in the US increased 300-fold in March and April 2020 compared to the same time period in 2019 (Epic Health Research Network). Providers have been pleased with their telehealth experience, and patients have too: 88% of patients new to telehealth said they would like to use it again (PwC Health Research Institute). The health system is eager to build on the implementation gains around virtual care made during the public health emergency, especially its ability to improve access to care and reduce costs.

Patient engagement in virtual care

Yet today, more than ever, it’s essential for health care clinicians and care teams to ensure that virtual care being provided is as patient-centered as possible. This topic was the focus of a May 6 webinar hosted by CQC, which highlighted presentations from a number of experts including Dr. Courtney Lyles, Associate Professor, Center for Vulnerable Populations at UCSF; Libby Hoy, Founder & CEO, PFCC partners; and Dr. Fiona Wilson, former Teladoc provider and current Supervising Clinician Specialist, Workers Compensation Division, Department of Human Resources, City & County of San Francisco.

Dr. Lyles shared examples from decades-long research done around patient portals, telephone visits and tactics that help bridge the “digital divide,” even in regions of strong technology adoption, such as the Bay Area. Her advice was not to make any assumptions about what patients do or do not have access to, and establish ongoing trainings, where patients can be assured to get continuous support for the virtual care they are seeking.

Libby Hoy of PFCC partners shared lessons from her organization’s history building patient advisory capacity. She cautioned that the work, especially at this time, is messy, but reminded care teams and providers that involving patients in the design process of the workflows results in more effective care.

Dr. Wilson shared her experience as a telehealth provider during COVID-19 for Teladoc, an organization that provides virtual care for patients all over the United States. Her advice for clinicians was to be an empathetic and engaged listener to patients when they are sharing their health issues, and make sure to ask about non-medical needs that may be even more present today, such as social isolation and economic hardship.

What providers can do now

Today, primary care practices are regrouping after shelter-in-place restrictions lift, adapting to a hybrid of virtual and in-person care, and working to address any care needs of their patients that were deferred during the height of epidemic. Yet even in this time of transition, CQC’s expert panelists shared the following steps practices can take to focus on patient needs:

- Always ask patients their preferences. Ask what technology they have access to, and what makes them comfortable. Make sure your visit builds on your relationship, addresses what device they are using and that you ask how you can be of help during this process.

- Look to your patients and families as resources to designing your telehealth programs. Outside even the visit, consider implementing patient open-ended surveys, focus groups, telephone calls or advisory programs. Tap into the people with the least experience to help you improve your work.

- Make workflows as simple as you can. Technology can be part of the barrier, but at the same time, almost everyone has a phone. Start with the tools that you and patients have. You don’t need a smart phone to conduct these visits.

Access CQC’s May 29 webinar recording and summary here.

Congress Gets Serious About COVID Phase 4 Legislation

May 18th, 2020

To date, Congress has passed four bills to combat the threat of COVID-19:

- March 6: Coronavirus Preparedness and Response Supplemental Appropriations Act (“Phase 1”) – $8.5 billion

- March 18: Families First Coronavirus Response Act (“Phase 2”) – $200 billion

- March 27: Coronavirus Aid, Relief, and Economic Security Act (CARES Act) (“Phase 3”) – $2.2 trillion

- April 24: Paycheck Protection Program and Health Care Enhancement Act (“Phase 3.5”) – $500 billion. This bill is colloquially known as “Phase 3.5” as it was primarily a vehicle to renew and extend funding authorized in “Phase 3.”

Notice a theme?

First, the cost of the bills has increased exponentially. In the span of just three weeks in March, the amount of money Congress believed was necessary to combat coronavirus multiplied by more than 250 times. (The White House’s original request for Phase 1 was just $2.5 billion.) Even the roughly $2.2 trillion allocated under the CARES Act – to date the costliest bill enacted in U.S. history – proved insufficient, and Congress found itself having to renew funding for several programs less than a month later.

Second, the pace of lawmaking has slowed considerably. Notwithstanding “Phase 3.5,” Congress went from passing a new bill roughly every 10 days to having not funded any new programs for nearly two months. Since Phase 3 was passed in late March, however, the number of confirmed COVID-19 cases in the United States has risen from just over 100,000 to more than 1.4 million, and the number of confirmed deaths has increased from roughly 2,000 to more than 80,000. Equally concerning, the economy has gone into free-fall, with the official unemployment rate hitting nearly 15 percent, the highest figure since the Great Depression nearly 90 years ago. Economists expect the unemployment rate to continue to climb.

While some on Capitol Hill and in the administration continue to urge a “wait and see” approach, it is becoming increasingly clear that Congress will have to pass at least one more large virus response and economic stimulus bill. Unlike previous bills, which passed relatively quickly and with overwhelming support, the debate over “Phase 4” is likely to be more in line with what we have come to expect from Washington – a bitter partisan battle.

House Democrats Make the Opening Move

On March 15, the House of Representatives, H.R. 6800, the Health and Economic Recovery Omnibus Emergency Solutions Act (HEROES) Act, largely on a party-line vote. Weighing in at around $3 trillion, it roughly equals the amount of federal funding allocated so far in the four previous bills.

Spanning more than 1,600 pages and hundreds of individual provisions, the bill is particularly noteworthy for the nearly $1 trillion for state and local governments, $200 billion in hazard pay for essential workers, and allocating another round of $1,200 stimulus checks to individuals. While Republicans have already called the HEROES Act “dead on arrival,” is represents the Democrats’ opening bid in what will be a prolonged debate. It is after House passage that “real” negotiations with the White House and congressional Republicans will begin.

Republican Priorities

Republican leaders and the Trump Administration have other priorities. Republicans are split on how costly a Phase 4 bill should be. While President Trump appears to have no concerns about crafting a large bill, fiscal conservatives on Capitol Hill and in the administration are expressing alarm about the aggregate cost of COVID-19 on the federal budget. It is safe to assume the final bill will be smaller – perhaps much smaller – than $3 trillion. One area Republicans are united on is the need for businesses that reopen after stay-at-home orders are lifted to be given indemnity against lawsuits by consumers who may be exposed to COVID-19. Separately, the President has urged Congress to provide a payroll tax holiday in the next bill, though that idea has only lukewarm support among Republicans and Democrats.

What About Employers?

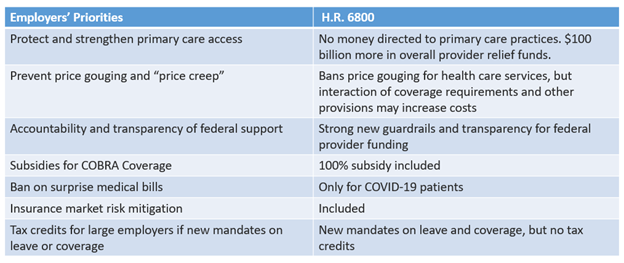

After passage of the CARES Act in late March, PBGH laid out a set of policy priorities on behalf of large employers with the overlying goal of helping employers continue to provide high quality health to their employees.

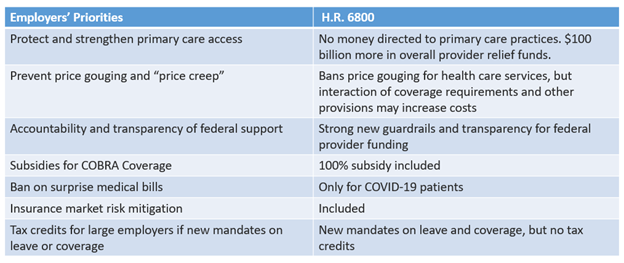

As noted in the chart below, the HEROES Act checks a few boxes, but there is still substantial room for improvement as we enter the coming debate.

As Congressional leaders begin to work out details of the final Phase 4 bill, PBGH will be engaging with congressional leaders on each of these topics, with a particular focus on strengthening the primary care system and preventing price spikes that could fundamentally destabilize the ability of its members to continue to provide high quality coverage to their employees. And on May 19, PBGH was jointed by 35 organizations representing many of the nation’s leading private and public sector employers in issuing a letter to congressional leaders requesting they take immediate action to ensure Americans have access to high-quality, affordable health care, both now and long after the COVID-19 pandemic ends.

Consequences of COVID-19: Experts Forecast the Future of Health Care Costs and Utilization

May 15th, 2020

The unprecedented collapse in patient volume sparked by the COVID-19 pandemic could reshape health care for years to come, but whether those changes ultimately prove beneficial or destructive remains to be seen, experts say.

What is clear is that significant risks and opportunities are beginning to emerge from the chaos surrounding the pandemic. Helping large employers understand and adapt to these developments was the primary goal of an expert panel discussion hosted May 6 by the Purchaser Business Group on Health.

Participants included Michael Chernew, director of the Healthcare Markets and Regulations Lab at Harvard Medical School; John Bertko, chief actuary and director of research for Covered California; and Jane Jensen, senior director of the health and benefits consulting practice with Willis Towers Watson.

Utilization off a Cliff

The extent to which demand for traditional health care services would be affected by COVID-19 wasn’t immediately clear as hospitals ramped up for worst-case scenarios and a surge in COVID-19 patients in early March. But with most elective surgeries cancelled and patients fearful of contracting the virus in any care setting, the utilization drop was immediate and severe for both hospitals and physician offices.

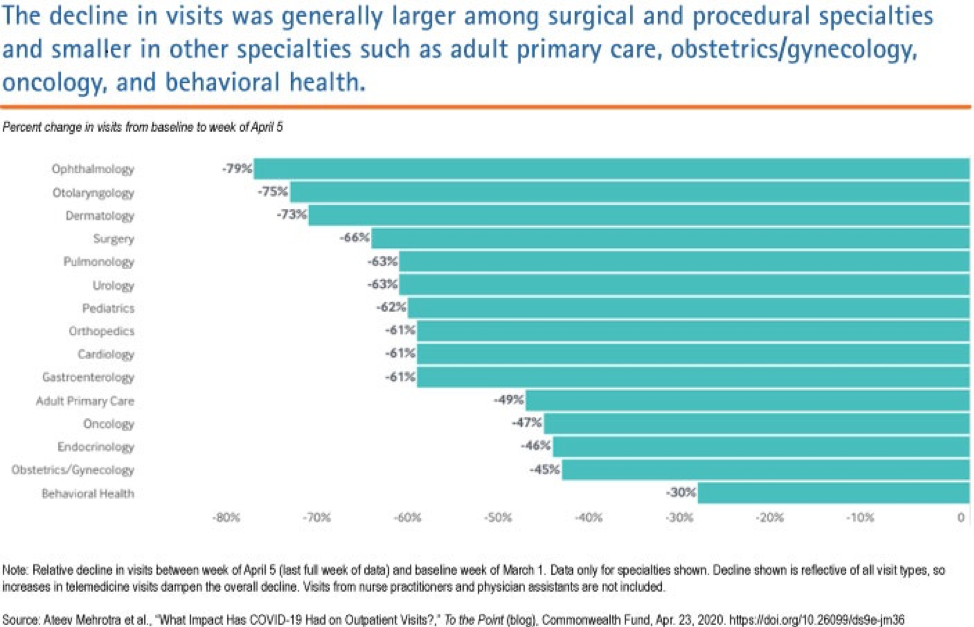

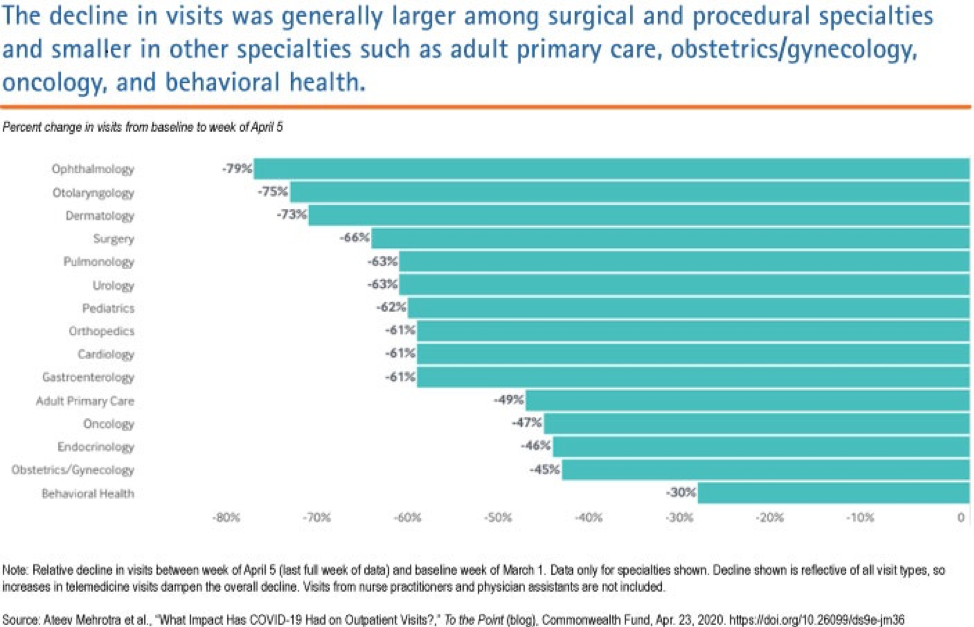

Chernew shared data provided by Phreesia, a health care technology company, and published by the Commonwealth Fund that showed the number of ambulatory practice visits nationwide (including telemedicine visits, fell by over 50% between March 1 and March 29. Office visits for some specialists dropped even more: Ophthalmology was down 79%; ear, nose and throat, 75%; dermatology, 73%; surgical office visits by 66%; and adult primary care by 49%. The most recent data from mid-April suggests only a slight recovery off the lows.

Hospitals have likely experienced similar drops in volume, with lost admissions far surpassing COVID-19 admissions and outpatient procedures down dramatically, Chernew said. At the same time, most are experiencing rising costs due to policy changes and equipment purchases necessary to combat the virus infection threat.

“By and large, hospitals are getting creamed right now financially,” he said.

Flipped Spending Projections: What It Means for Employers and Employees

The good news from an employer standpoint is that because of the volume collapse, pandemic-related health care cost increases projected as recently as six weeks ago now seem unlikely, and though there is a wide range of uncertainty, health care spending could actually fall by 5% in 2020 and remain flat or continue to drop in 2021, according to Chernew. That should translate to lower fees and health care spend for administrative services only (ASO) plans, with the savings accruing directly to employers, and by extension, their employees.

Jensen of Willis Towers Watson projected similar reductions in employer health care costs, a reversal from the estimated increases for 2020 made in mid-March that ranged from 1% to 7%, depending on COVID-19 infection rates and hospitalization rates. With infection numbers far lower than expected, Willis Towers Watson is now predicting spend reductions ranging from 1% to 4.5% for 2020. She said her organization anticipates COVID-19 workforce infection rates of about 1% for most employers, far lower than the 10-50% range initially predicted.

Given the backdrop of a federal deficit expected to exceed $4 trillion this year and the nation’s ongoing, Depression-level economic contraction, Chernew said pressure to control health care spending will continue.

“There’s going to be less money for everything,” he said. “Going forward, everyone is going to be looking to save money on health care.”

He predicted employers will likely reduce benefit generosity and narrow networks to accomplish cost reductions. But Jensen said many employers at this point are primarily focused on ensuring that coverage remains affordable for employees. Noting that many firms have already faced “gut-wrenching” decisions about layoffs, she believes most are more likely to look for savings through limits on provider choice as opposed to benefit reductions.

“I don’t think they don’t want to nickel-and-dime [those employees that remain] by changing benefits,” she said.

How Much Comes Back?

Bertko of Covered California and the other panelists agreed that vast uncertainty surrounds the ultimate disposition of care deferred during the pandemic.

“How much will we see rescheduled in the second half of 2020? How much will be deferred until 2021? And how much will just drift away and disappear?,” Bertko said. In his view, it will take considerable time before patients feel comfortable coming back into office settings.

Jensen’s organization analyzed the volume and types of care currently being deferred. The results ranged from high levels of deferral for office visits, dental care and non-urgent procedures to lower levels with acute emergency care and cancer care. The analysis further suggested that while some of this volume would be rescheduled, the majority would not, particularly when it came to office visits and urgent care.

Noted Chernew: “You can’t have a 50-60% drop and then expect that as soon as things open back up, everybody’s going to be doing 120% until they work their way through the backlog.”

All panelist agreed a potential second wave of pandemic infection was a wild card that could extend and exacerbate the demand decline.

Risks and Opportunities

Should the volume reduction prove protracted, the implications for all providers are grim. Hardest hit will likely be already underfunded and vulnerable primary care practices. Bertko said primary care groups in California are seeing as much as a 70-80% decrease in office visits.

A survey of primary care providers in late March revealed that nearly 80% of clinicians reported their practice was facing severe or close-to-severe financial strain, and 20% said their group might need to close temporarily. If the financial pressure continues, some practices could close permanently or be acquired by large health systems, insurance companies or even venture capital firms.

Panelists said the consolidation of primary care practices could reduce carriers’ ability to negotiate better prices on behalf of employers, disrupt existing provider networks and limit progress toward pay-for-performance reimbursement models.

“We at Covered California do not want primary care practices bought up by several very large hospital systems,” Bertko said.

For employers, the current landscape presents substantial opportunities to focus on benefit designs that more effectively steer employees to high-performance providers and accelerate the transition to value-based reimbursement, Jensen said.

“Not all hospitals are created equal,” she said. “So payment reform and steerage go hand-in-hand. But at the same time, we really need to be mindful of total cost of care and not just focus on price.

“We also have to recognize that providers need to stay in business. Ultimately, we need to find ways to pay the right amount, fairly, to the right folks, and not cut off our nose to spite our face.”

The panelists agreed that determining whether the patient volume decline is temporary or marks a sea-change in how health care services are consumed represents the most important unanswered economic question surrounding recent events.

“We are in the midst of a natural experiment,” Bertko said.

Added Jensen: “What’s happening now may or may not change patterns longer term; people may or may not think differently about how they use healthcare in the future.”

While a permanent reduction in overutilized, low-value care would be a major positive for the system as a whole, finding ways to prevent it from coming back as providers scramble to recover lost revenue will likely prove “a huge challenge,” Chernew said.

The Stakes for Primary Care – Impact of COVID-19 and the Urgent Need for Action

May 1st, 2020

The COVID-19 pandemic has infected nearly 1 million people in the United States, killed tens of thousands, and is having an unprecedented negative effect on the country’s economy. It has also strained primary care providers to near the breaking point. Nearly half of independent primary care practices report that they are in danger of closing in the coming months due to a collapse in revenue. Primary care practice closures threaten patients’ access to health care during this pandemic and afterward.

On April 30, PBGH teamed up with the American Academy of Family Physicians (AAFP) and the Partnership to Empower Physician Led Care (PEPC) to host a virtual Capitol Hill briefing attended by more than 100 congressional staff and interested stakeholders. The briefing was opened by the co-chairs of the bipartisan Congressional Primary Care Caucus, Reps. Joe Courtney (D-CT) and David Rouzer (R-NC), and featured expert speakers, including PBGH’s President and CEO, Elizabeth Mitchell, and the AAFP’s incoming CEO, Shawn Martin.

Primary Care Doctors Share Their Story

The highlight of the event was a panel discussion featuring three front line primary care clinicians, who discussed their own personal challenges in delivering care and keeping the doors open in the era of COVID-19.

These physicians all described the financial hole they find themselves in as office visits abruptly fell off, and the frightening prospect of going out of business and leaving their patients with nowhere else to turn. They talked about the 20-hour workdays for themselves and their staff as they work to manage the concerns and health conditions of thousands of people who entrust them with their medical needs — all while abruptly shifting to deliver care via phone or video chat.

The move to telehealth has been both welcomed and challenging. Through a fuzzy online connection, one doctor talked about the poor broadband access in her small, rural town, and how the financial strain of COVID-19 on her practice required her to choose between upgrading her 15-year old audio visual equipment to improve visibility for online patient visits, or to provide her staff with needed personal protective equipment (PPE).

Another physician described his frustration with insurers who have largely failed to step forward to provide primary care doctors with the support needed to stay afloat and available to millions of patients nationwide.

“We’ve saved our country and insurance companies millions of dollars, and I’m sitting here dying,” he told participants of the briefing. He was recently forced to furlough 75 members of his staff and shared that he and his fellow physicians were now working unpaid.

Taking Action — NOW

As the panel demonstrated, absent an aggressive federal response, the country’s primary care delivery system is on the verge of collapse. PBGH, AAFP, and PEPC delivered clear recommendations to Congress for immediate legislative action in five major policy areas:

- Provide immediate financial assistance to ensure physician practices can survive the sudden and significant loss of revenue and can continue to serve their patients

- Ensure long-term sustainability by expanding opportunities for physician practices to participate in value-based payment models that increase investment in primary care

- Promote telehealth coverage and reimbursement policies that maximize patients’ access to care while preserving and strengthening the physician-patient relationship

- Encourage benefit design that prioritizes primary care and reduces cost barriers

- Curtail health care provider consolidation and increase transparency

The event’s slide deck, including detailed policy recommendations, and a full recording of the briefing are available online.

Doctors Expect to Use Telehealth More Extensively Post COVID-19

April 27th, 2020

Physicians Embracing Telehealth During Pandemic

Telehealth is quickly emerging as an important clinical tool for physicians scrambling to adapt to the COVID-19 pandemic. Both patients and physicians report being happy with treatment delivered via telehealth, but doctors say barriers to adoption still exist.

Two April surveys conducted by the Pacific Business Group on Health’s California Quality Collaborative, during a webinar with independent physician associations (IPAs), community health clinics and managed services organizations, found that more than 80% of polled physician practices in California are presently using telehealth to deliver care.

Most practices report having launched telehealth services in earnest only in the three-to-four weeks after the pandemic’s shelter-in-place orders rolled out. Providers are using a combination of both telephone and video technologies not only for COVID-19 patient screening, but also urgent care, wellness visits and other clinical services.

Nearly three-quarters of poll respondents said clinicians were satisfied or very satisfied with providing care via telehealth.

Nonetheless, uncertainties remain about payment, policy and patient uptake of this technology. About one-third of respondents said policies on payment for telehealth were confusing or very confusing, and 64% said they need more guidance from health plans on billing.

Notably, about 40% of IPA representatives said they were extremely or very worried about their organizations’ financial health, while another 47% said they were somewhat worried.

During CQC’s webinars, IPAs and small physician practices identified a range of additional barriers to launching or expanding telehealth, including:

- Helping patients adopt telehealth, notably older patients without smartphones or with low digital literacy

- Reaching hard-to-find patients, like homeless patients without phones

- Improving patient acceptance and technical training (providers did note that when patients tried telehealth, they generally liked it)

- Providing staff training

- Documenting and coding for telehealth visits

Despite the challenges, there’s broad agreement that the COVID-19 epidemic has helped to push past resistance to the more widespread use of telehealth; 94% of IPA respondents tell PBGH that they expect to use telehealth differently or more extensively once the pandemic begins to abate.

COVID-19 Policy & Politics: Employers Take a Leadership Role

April 23rd, 2020

The health care provisions of COVID-19-related legislation to date have focused primarily on ensuring health care providers have the resources they need to treat the influx of affected patients. In addition, Congress has rightly taken steps to slow the spread of the virus, ensure that patients have access to needed tests and treatment, and protect workers and businesses from the collapsing economy.

As Congress considers “Phase 4” legislation, it should seek to build upon the foundation set by the earlier legislation, with a particular focus on the downstream financial effects of the crisis. In the best interest of American businesses and consumers, the next wave of legislation should focus on seven priorities.

1. Maintain and Strengthen Primary Care

Many primary care groups are reporting dire financial situations and the possibility of imminent closure due to the loss of patient revenue during the COVID-19 crisis. In addition to the funding provided to-date for hospitals and providers (an unknown portion of which is likely to make it to primary care providers), Congress should specifically earmark financial support to vulnerable primary care practices. This is critical to ensure that primary care survives and thrives in the aftermath of the COVID-19 crisis.

In addition, Congress should take this opportunity to accelerate the move away from fee-for-service payment for primary care to a model that is prospective, population-based, team-based and addresses social needs[1].

2. Prohibit Price Gouging and Ban Surprise Billing

Media reports indicate that personal protective equipment (PPE) and other supplies have seen exorbitant price increases.[2] We need to ensure that the small number of unscrupulous actors do not take advantage of this crisis to engage in price gouging. During the pandemic, policymakers should explicitly ban price gouging on any health care items or services, prosecutable by the Federal Trade Commission and State Attorneys General.

In addition, Congress has been debating legislation to ban surprise medical bills for more than a year. With tens of thousands of people now seeking care for COVID-19, many will be forced to see out-of-network providers due to the overwhelmed health care system. It is more important than ever that Congress prioritize banning this abusive practice. This legislation should protect patients and hold down health care costs by using a local, market-based benchmark payment rate for out-of-network care.

3. Ensure Accountability and Transparency for Federal Funds

The CARES ACT (H.R. 748) and subsequent legislation provide more than $175 billion in direct financial support to hospitals and other health care providers. This funding is in addition to other financial support to hospitals, including suspension of budget sequestration, extension of Medicare Disproportionate Share Hospital payments, COVID-19 related add-ons, and others. Unlike the funding provided to other businesses, however, this funding provided to hospitals and other health care providers does not come with any meaningful transparency or accountability. To ensure reasonable oversight of federal taxpayer funding, policymakers should extend the same requirements as stipulated for other businesses.

4. Provide Risk Mitigation Mechanism

According to an analysis prepared for Covered California, the potential cost of coverage for COVID-19 related services could exceed $200 billion.[3] In the short-term, those costs may be offset by reduced demand for elective procedures. In the longer term, however, pent-up demand could substantially increase utilization once the pandemic has subsided. With health plans unable to accurately forecast cost effects, their fear about future costs could cause premiums to spike by as much as 40 percent.[4] Congress should avert potential premium spikes by enacting policies that protect insurers and self-insured employers from unexpected costs in the 2020 and 2021 plan years. Such policies could include a reinsurance mechanism or one-sided risk corridor, which would “kick in” only if costs exceed a certain threshold.

5. Expand Access to Affordable Coverage

With millions of Americans losing jobs and income as a result of social-distancing measures, Congress should take immediate action to make affordable coverage available to those who have lost their jobs and access to employer-sponsored coverage. Congress should provide subsidies for COBRA coverage for the duration of the crisis and offer a special open enrollment period for the health care exchanges. In addition, we need to find ways over the longer-term to provide coverage to everyone – for example, with enhanced subsidies for low-income people to buy individual coverage and financial incentives for all states to expand their Medicaid programs. At the same time, we need to ensure that coverage expansion is accompanied by meaningful policies to reduce the costs of our health care system.

6. Prevent “Price Creep”

The CARES Act provides more than $175 billion in direct financial support to hospitals and other health care providers to help them deliver care to all patients during this public health emergency. However, despite this infusion of funds, we are concerned that some hospitals and providers will increase their future prices above what they had originally planned. This would cause overall health care costs to increase dramatically. To prevent this, policymakers should consider limiting price increases.

7. Place a Moratorium on Industry Consolidation

During the COVID-19 crisis, many independent physician practices are under extreme financial duress, and some hospitals and health systems may take advantage of this opportunity to acquire these vulnerable practices at “fire sale” prices. To prevent this anti-competitive behavior, which has been shown to increase prices in the commercial market, Congress should consider a temporary moratorium on mergers and acquisitions among hospitals, health systems, health plans and physician groups.

[1] One example of this is the AAFP’s proposed Advanced Primary Care Alternative Payment Model that was approved by PTAC. https://www.aafp.org/news/macra-ready/20171219apc-apm.html

[2] https://www.cbsnews.com/news/china-ppe-us-buyers-knock-offs-price-gouging/

[3] https://hbex.coveredca.com/data-research/library/COVID-19-NationalCost-Impacts03-21-20.pdf

[4] ibid.