Vertical Integration Isn’t Great for Health Care Consumers or Purchasers

TOPLINES

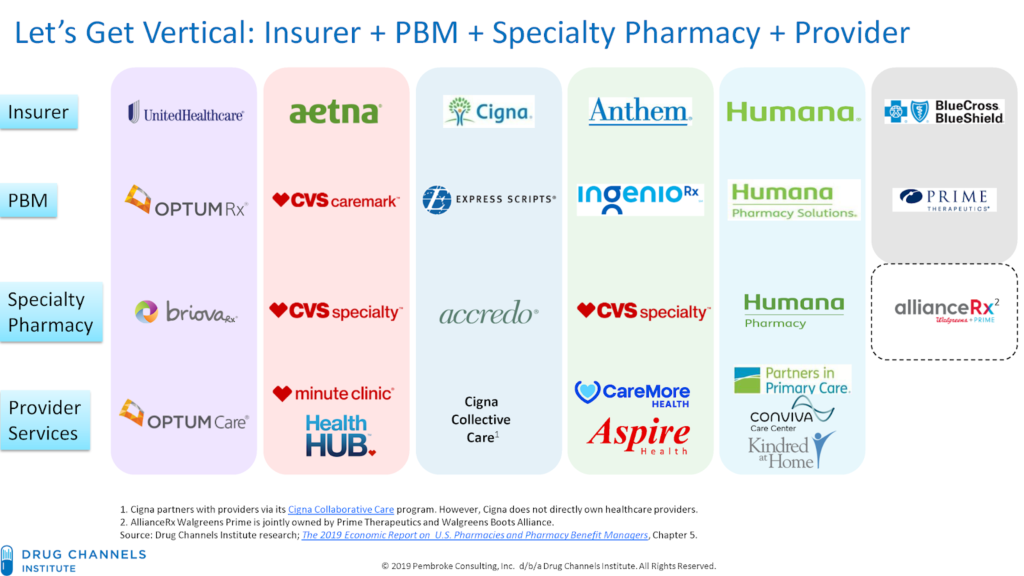

In 2017, pharmacy giant CVS announced its purchase of insurer Aetna for $69 billion in the largest-ever health care merger. This is just one example we have seen in recent years of the acceleration of acquisitions combining traditionally independent elements of the health care supply chain.

Problems posed by vertical integration

Known as vertical integration mergers, these deals have led to hyper-consolidation between health insurers, providers, pharmacy benefit managers (PBMs) and other sectors of the health care market. Today, three entities—CVS-Aetna, Cigna-Express Scripts and UnitedHealth-OptumRx—control nearly 80% of the PBM market. OptumCare, owned by UnitedHealth, now employs or is affiliated with 50,000 physicians and 1,400 clinics, and they anticipate hiring at least 10,000 more providers by the end of 2021.

While the emerging mega-companies have argued that mergers help consumers and purchasers by holding down costs, there is scant evidence that increased consolidation reduces inefficiency and waste, improves quality or decreases costs. On the contrary, evidence suggests market consolidation, including vertical integration, has contributed to rising costs and lower-quality care.

One recent study found that diagnostic imaging and laboratory referrals from physicians increased significantly after the physicians’ practices were acquired, boosting Medicare spending by $73 million during a four-year-period across the 10 imaging and lab services reviewed. Another study that examined claims data from 2009 to 2016 determined that the odds of a patient receiving an inappropriate MRI referral increased by more than 20% after a physician transitioned to hospital employment.

More aggressive oversight needed

The only solution to the problems posed by the increasing number of vertical integrations in the health care industry is more aggressive oversight and enforcement of anti-trust laws.

The federal government has begun to take steps toward the oversight needed. Guidelines issued by the Federal Trade Commission (FTC) and Department of Justice in June 2020 represent the first-ever vertical merger-specific guidelines and replace broader merger guidance published in 1984. Although vertical mergers traditionally have faced little scrutiny by regulators, the new rules may usher in a more aggressive chapter of anti-trust enforcement around the transactions.

In July 2021, the Biden administration signaled it was taking seriously risks associated with vertical mergers in a sweeping executive order aimed at increasing competition and reducing anti-competitive consolidation across multiple sectors. The order contains directives for the Justice Department and FTC to “enforce the anti-trust laws vigorously” with respect to hospital mergers. It also directs federal agencies to address consolidation in other health care sectors, including pharmaceuticals and health insurance.

In another positive sign, the Department of Justice sued to stop the merger of Aon and Willis Towers Watson, two of the nation’s largest insurance brokers. Though an example of horizontal, rather than vertical integration, the suit – which led to the two companies calling off the merger in July – demonstrates the administration’s skepticism of greater consolidation in the health care industry. As alleged in the suit,

Aon and Wills Towers Watson operate “in an oligopoly” and “will have even more [leverage] when [the] Willis deal is closed.” If permitted to merge, Aon and Willis Towers Watson could use their increased leverage to raise prices and reduce the quality of products relied on by thousands of American businesses — and their customers, employees, and retirees.

Health care mergers, whether vertical or horizontal, must benefit the people served by the entities involved. The federal government’s continued steps to strengthen anti-trust laws and closely review every proposed merger is essential to getting costs under control and ensuring Americans have access to quality health care services.